Kazatomprom, the world’s largest uranium producer, has announced a significant agreement with two Chinese entities, CNNC Overseas Limited and China National Uranium Corporation Limited (CNUC), for the sale of natural uranium concentrates. The deal, announced on Tuesday, further strengthens Kazakhstan’s position as a critical supplier of nuclear fuel to China’s rapidly growing nuclear energy market.

In its statement, Kazatomprom emphasized the scale of the agreement: “The transaction value, cumulative with the previously concluded transactions with CNUC and CNNC Overseas, comprises fifty percent or more of the total book value of the company’s assets.”

The magnitude of the deal means it will require shareholder approval at a meeting scheduled for November 15. However, Kazatomprom did not disclose the volume of uranium involved.

Kazatomprom’s Role in Kazakhstan’s Nuclear Energy Ambitions

This announcement comes at a time when Kazakhstan is making significant strides in its nuclear energy sector. On October 6, a national referendum saw 71.12% of voters express support for the construction of a nuclear power plant (NPP) on the shores of Lake Balkhash, a project estimated to cost between $10 bn and $15 bn. This new nuclear facility is expected to help address southern Kazakhstan’s energy deficit by 2035.

Kazakhstan, which is the world’s largest uranium producer, is leveraging its position in the global nuclear fuel supply chain to strengthen its domestic nuclear energy capabilities. President Kassym-Jomart Tokayev has called the nuclear plant “the largest project in the history of independent Kazakhstan,” highlighting the importance of nuclear generation for the country’s future energy security.

Kazatomprom’s uranium production is expected to play a crucial role in both domestic and international nuclear energy projects. The company’s latest deal with China aligns with Kazakhstan’s growing nuclear energy ambitions, as China continues to expand its nuclear power capacity as part of its push toward cleaner energy sources.

Nuclear Energy Debate in Kazakhstan

While the Kazatomprom deal highlights the country’s strong international partnerships in nuclear energy, the domestic debate over nuclear power is ongoing. The proposed nuclear power plant on Lake Balkhash has generated mixed reactions. Although 71.12% of voters in the recent referendum supported the project, there is significant opposition from environmentalists and civil society groups who raise concerns about potential environmental risks and the high costs of decommissioning.

Kazakhstan’s history with nuclear testing, particularly at the Semipalatinsk site, continues to influence public sentiment, with many citizens cautious about the risks of nuclear power. President Tokayev acknowledged these concerns, emphasizing that while Kazakhstan needs its own nuclear generation, it must also ensure the highest safety standards.

Strategic Importance of the Deal

This latest deal with CNNC and CNUC is another step in deepening Kazakhstan’s economic cooperation with China. As China builds more nuclear power plants to meet its clean energy goals, securing reliable uranium supplies is a priority. For Kazakhstan, these partnerships not only strengthen its export economy but also align with its domestic energy strategies, including the ambitious plan to construct a new nuclear power plant.

About the Chinese Partners

CNNC Overseas Limited is a subsidiary of China National Nuclear Corporation (CNNC), a key player in China’s nuclear power sector. CNNC oversees the full nuclear energy chain, from uranium mining to reactor operations, and is integral to China’s efforts to transition to low-carbon energy.

China National Uranium Corporation Limited (CNUC), another major player under CNNC, focuses on uranium exploration, mining, and processing. CNUC ensures China’s long-term supply of uranium for its expanding nuclear fleet, making this agreement with Kazatomprom crucial for China’s energy security.

In addition to Kazakhstan, China’s nuclear companies source uranium from several countries to secure a stable supply for their expanding nuclear energy needs. Some of the key uranium suppliers for China include:

1. Kazakhstan:

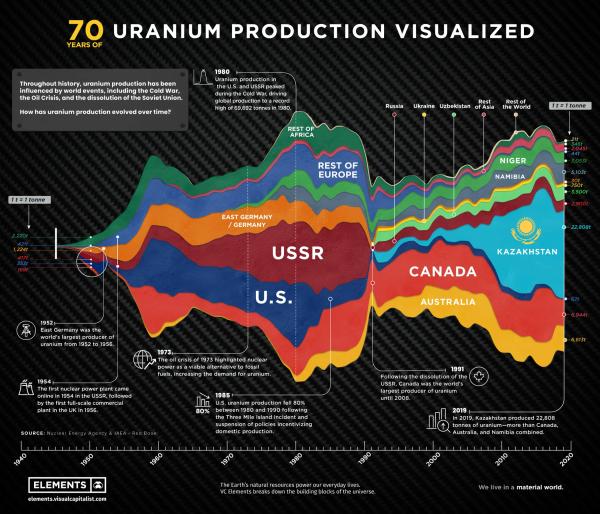

•Kazakhstan is the largest supplier of uranium globally, accounting for around 40% of the world’s total uranium production. In 2022, Kazakhstan produced 21,227 tonnes of uranium.

•China has been a key buyer of Kazakh uranium through partnerships like Kazatomprom, supplying a significant portion of the uranium that fuels China’s nuclear reactors. The country is expected to continue playing a critical role in China’s energy strategy with deals like the recent Kazatomprom-CNNC/CNUC agreement.

2. Canada:

•Canada is the second-largest producer of uranium in the world, producing 7,351 tonnes in 2022. The majority of this production comes from the McArthur River and Cigar Lake mines, operated by Cameco.

•Canada has long-term agreements with China to supply uranium, ensuring a steady flow of nuclear fuel. For example, Cameco signed a 10-year supply contract with China’s CNNC in 2013, and since then, Canadian uranium has been a vital part of China’s nuclear energy supply chain.

3. Australia:

•Australia holds the world’s largest recoverable uranium reserves but only produced 4,192 tonnes of uranium in 2022, mainly from the Olympic Dam and Ranger mines.

•Australia has been supplying uranium to China since a bilateral nuclear cooperation agreement in 2006. The country remains one of China’s top suppliers, with the Australian government allowing uranium exports to China for civilian nuclear purposes, which contributes significantly to China’s nuclear fuel needs.

4. Namibia:

•Namibia is the fourth-largest uranium producer, with an output of 5,613 tonnes in 2022, primarily from the Rossing and Husab mines.

•The Husab mine, in which China’s CNNC holds a majority stake, is one of the largest uranium mines in the world. Chinese investment in Namibia ensures a reliable and long-term supply of uranium for China’s nuclear reactors, with Husab producing around 3,100 tonnes annually.

5. Uzbekistan:

•Uzbekistan is an emerging uranium supplier, producing 3,500 tonnes of uranium in 2022. Uzbek uranium has become increasingly important for China as the two countries continue to strengthen energy cooperation.

•China and Uzbekistan signed several agreements for uranium supply, with Uzbekistan becoming a strategic partner in diversifying China’s uranium imports, reducing its reliance on any single source.

6. Russia:

•While Russia is not one of the top uranium producers (producing 3,200 tonnes in 2022), it plays a significant role in the global nuclear fuel market through Rosatom, the Russian state nuclear energy corporation.

•Russia supplies nuclear fuel and services to China, with several reactors in China using Russian technology. This cooperation ensures that China’s nuclear fuel needs are met not only through raw uranium but also through Russia’s comprehensive nuclear services.

Further details regarding the Kazatomprom agreement are expected following the shareholder meeting in November.