Uzbekistan’s real GDP growth is projected to remain close to 6% in 2025 and 2026, according to the IMF’s Staff Concluding Statement following the 2025 Article IV Mission to Uzbekistan. The outlook is supported by strong private consumption, ongoing investment, and continued structural reforms despite growing external uncertainty.

In 2024, Uzbekistan’s economy expanded by 6.5%, driven by strong domestic demand. The external current account deficit narrowed to 5.0% of GDP, down from 7.6% the previous year, as remittances remained strong, non-gold exports expanded, and a one-time import surge in 2023 subsided. International reserves stayed ample, and the consolidated government deficit dropped to 3.2%, reflecting reduced energy subsidies and better-targeted social spending.

Headline inflation stood at 10.3% year-on-year in March 2025. This elevated rate was primarily due to past increases in energy tariffs and other administered prices, which have spilled over into broader price levels. The IMF expects inflation to moderate to slightly above 8% by end-2025, and continue to decline gradually with the help of tight monetary policies and reform progress.

The global environment, however, presents new challenges. Rising global tariffs, tightening financial conditions, and potential volatility in commodity markets could affect Uzbekistan’s exports, capital flows, and external financing. Domestically, risks include widening fiscal deficits, upward revisions to borrowing ceilings, and contingent liabilities from state-owned enterprises and banks.

Fiscal Policy and Spending Reforms

The IMF commended the government’s efforts to reduce the consolidated government deficit and remain aligned with its medium-term target of 3% of GDP. Authorities are urged to maintain the $5.5bn external borrowing ceiling in 2025 and ensure borrowing does not push public debt beyond sustainable levels. The Fund noted that fiscal responses to fluctuating gold prices should be minimized to avoid macroeconomic volatility.

To support development and social spending, a comprehensive medium-term revenue strategy is needed. The IMF recommended reforms to personal and corporate income taxes, phasing out ineffective tax exemptions, and strengthening revenue administration. Cost rationalization in public sector wages, procurement, and social programs, alongside reforms to the pension system, would improve spending efficiency.

On institutional reform, the government was praised for improvements in fiscal transparency, including the preparation of the 2025–2030 Public Financial Management Reform Strategy and adherence to budget planning procedures. Further integration of capital and current budgeting, strengthened monitoring of public-private partnerships (PPPs), and enhanced debt reporting are seen as next steps.

Monetary and Exchange Rate Policy

The Central Bank of Uzbekistan (CBU) has taken appropriate steps to tighten monetary policy amid persistent inflation. The IMF encourages the CBU to maintain a data-driven approach and allow for greater exchange rate flexibility, which would help absorb shocks, preserve reserves, and foster better hedging practices among businesses.

Strengthening monetary transmission mechanisms and reducing dollarization remain key priorities. This includes improving liquidity management, modernizing reserve requirements, and reducing the state’s role in the banking sector.

Banking Sector and Financial Stability

The IMF urged the Uzbek authorities to accelerate the privatization of state-owned commercial banks (SOCBs) and improve their corporate governance. SOCBs should operate on commercial terms, with transparent compensation for non-commercial mandates until they are phased out. Plans to retain some systemic banks as policy banks were discouraged due to potential financial and fiscal risks.

Bank supervision and regulation must align with international standards, as recommended by the IMF’s Financial Sector Assessment Program (FSAP). Reforms should include robust stress testing, enhanced capital requirements, and mechanisms for crisis management. The CBU should also address rising risks in rapidly growing segments like microlending and foreign exchange lending to unhedged borrowers.

Structural and Governance Reforms

Uzbekistan has made notable progress in market liberalization, energy pricing reforms, and WTO accession talks. However, the IMF emphasized the importance of completing these reforms and accelerating the privatization of large state-owned enterprises. Regulatory frameworks should replace direct government intervention, and the private sector should be supported through competitive, market-based practices.

Governance improvements are ongoing. The IMF welcomed the conflict-of-interest law, public service training programs, and anti-corruption efforts including the Virtual Academy and draft laws on whistleblower protection and asset declarations. Continued reform in labor markets, particularly to address informality and low female participation, is also recommended.

Climate policy remains a key area of focus. Finalizing the energy reform agenda, improving water use efficiency, diversifying agriculture, and promoting reforestation will contribute to climate resilience.

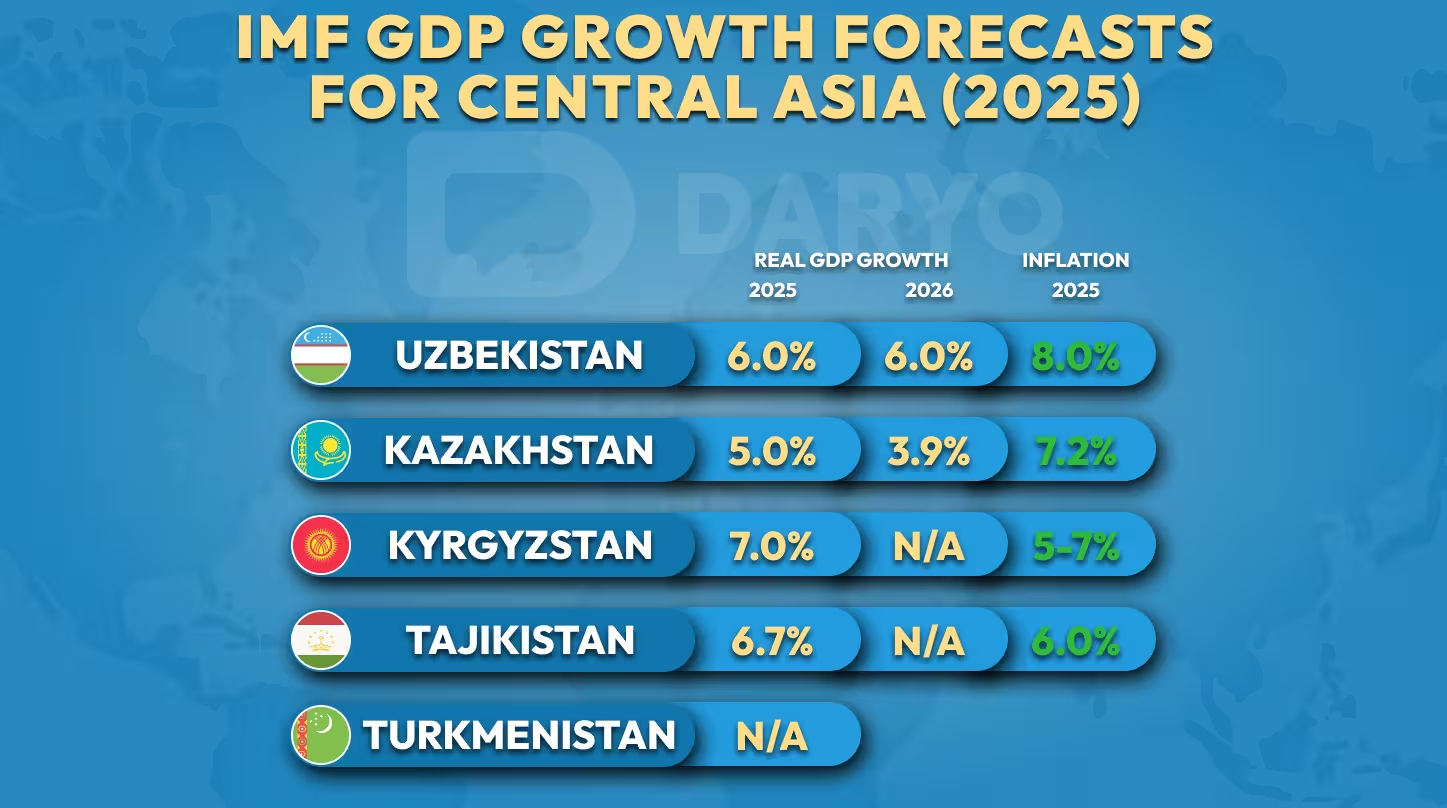

Comparing Central Asia’s Economic Outlook

While Uzbekistan’s real GDP growth is projected to remain close to 6% in both 2025 and 2026, other Central Asian economies show diverging trends.

Kazakhstan is expected to grow by 5.0% in 2025, before slowing to 3.9% in 2026. Inflation remains relatively elevated, with headline consumer prices projected at 7.2% (end of period) in 2025, easing to 6.2% in 2026.

Kyrgyzstan continues to demonstrate strong post-pandemic recovery momentum. Real GDP growth is forecast to moderate to below 7% in 2025, converging toward 5.25% over the medium term as the country moves past the exceptional gains from unrecorded re-exports. Inflation is projected to stay within the 5–7% target range. While public debt has declined substantially, the current account deficit remains a concern, largely influenced by unrecorded re-export trade and large-scale infrastructure investments such as the Kambarata-1 HPP and China-Kyrgyzstan-Uzbekistan railway.

Tajikistan is forecast to see GDP growth slow to 6.7% in 2025 from 8.3% in 2024, as remittance inflows normalize. Inflation is expected to reach 6% in 2025, within the central bank’s target. The fiscal deficit is projected to remain anchored at 2.5% of GDP, supporting a declining debt trend. FX reserves remain healthy, covering about seven months of imports.

Turkmenistan, meanwhile, was not included in the IMF’s most recent regional projections, making it difficult to directly compare its outlook with neighboring countries.

Other Forecasts

Earlier, the Asian Development Bank (ADB) forecasted that Uzbekistan’s economy will expand by 6.6% in 2025, with even greater growth anticipated in 2026. Despite expected increases in energy prices, inflation is projected to decrease to 8.0% in 2025 and 7.0% in 2026.

For neighboring countries, Kazakhstan’s GDP is expected to grow by 4.9% in 2025 and 4.1% in 2026, with inflation projected to be 8.2% in 2025 and 6.5% in 2026. In Kyrgyzstan, GDP growth is forecasted at 8.5% in 2025 and 8.6% in 2026, while inflation is projected to be 6.0% in 2025 and 7.8% in 2026.

Turkmenistan’s GDP is anticipated to grow by 6.5% in 2025 and 6.0% in 2026, with inflation estimated to remain at 6.0% for both years. Similarly, Tajikistan’s economy is projected to expand, with GDP growth forecasted at 7.4% in 2025 and 6.8% in 2026, and inflation expected to be 5.0% in 2025 and 5.8% in 2026.

The World Bank has also released its projections for Central Asian countries, with Uzbekistan’s GDP expected to grow by 5.9% in both 2025 and 2026. Kazakhstan is forecasted to see GDP growth of 4.5% in 2025, slowing to 3.6% in 2026. Tajikistan is projected to grow by 6.5% in 2025 and 4.9% in 2026, while the Kyrgyz Republic is expected to experience 6.8% growth in 2025, with a slight dip to 5.5% in 2026.

Despite a broader regional slowdown, Central Asia is set to remain the fastest-growing subregion, with an overall growth forecast of 4.7% during this period. This deceleration is primarily driven by slower oil sector growth in Kazakhstan, a decline in exports, and the normalization of remittance flows.