The Tashkent Stock Exchange (TSE) witnessed a substantial decline in trading volume this past week, with total turnover plummeting to $173,895 (UZS 2.2bn), marking a 25.3-fold decrease compared to the previous week. This sharp drop is primarily due to the absence of significant mergers and acquisitions (M&A) transactions, which had heavily influenced last week’s figures as reported by the Avesta Investment Group.

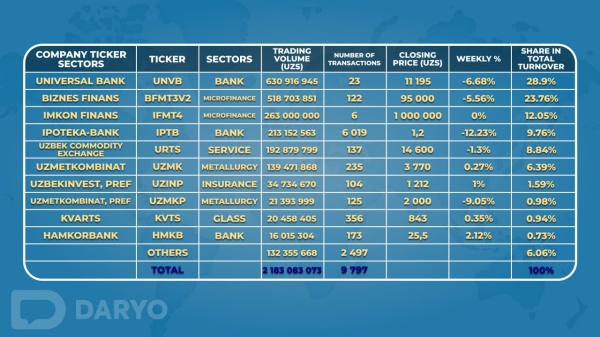

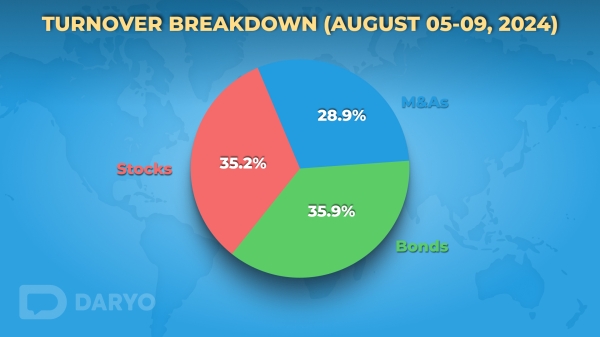

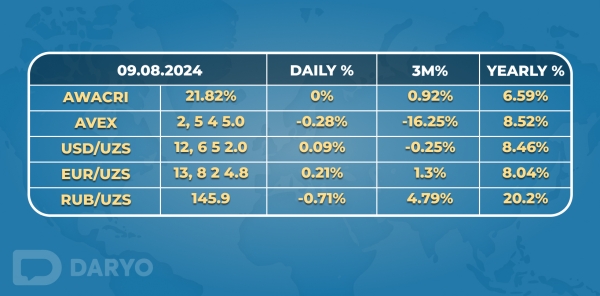

Previously an M&A deal involving UNVB shares valued at $3.1mn accounted for 72.6% of the turnover contributing to the prior week’s heightened activity. In contrast, the latest week saw only 63 securities traded six fewer than before with bonds dominating the market and making up 35.9% of the total turnover. Key bonds included BFMT3V2 and IFMT4 while UNVB shares again led stock transactions comprising 28.9% of the total market volume. Other notable stocks were IPTB and URTS which represented 9.8% and 8.9% of the turnover respectively. Price movements were mixed with IPTB and UZMKP seeing significant declines of 12.2% and 9.1%, while HMKB and UZINP registered the highest price increases at 2.1% and 1.0%, respectively. Meanwhile, AVEX experienced a slight decrease of 0.2% during the week.

In economic developments, a Chinese company announced a $50mn investment to construct a mining complex in the Tashkent region expected to produce 2.4mn tons of ore annually and create 450 jobs. Additionally, Uzbekistan emerged as one of the top gold buyers in June 2024 purchasing 9 tons alongside India. The International Finance Corporation (IFC) placed a new round of UZS denominated bonds on the London Stock Exchange valued at UZS 250bn ($20mn), with a maturity date in April 2030. In the banking sector, the volume of car loans issued in the first half of 2024 amounted to $7bn, reflecting a sharp decrease compared to the previous year. Uzum, a key player in Uzbekistan’s tech and finance sectors reported a 50% increase in net income in the first half of 2024 indicating strong financial growth.

Furthermore, Uzbekistan’s foreign reserves increased from $36.3bn to $37.4bn, with gold reserves rising by $1.8bn or 0.4mn ounces in physical amount. In public finance the state budget deficit reached $28bn by July 2024 although the pace of deficit growth slowed to $1.9bn in the past month. The tourism sector continued its upward trend with 3.5mn tourists visiting Uzbekistan in the first half of 2024, a 13.3% increase from the previous year potentially reaching 10mn visitors by year-end.

The week also saw significant financial activities with SQB JSCB placing bonds on the London Stock Exchange raising nearly $579mn in two tranches. The Uzbekistan Mortgage Refinancing Company (UzMRC) listed new corporate bonds on the Tashkent Stock Exchange and secured a $45mn loan from the IFC while Kvarts JSC obtained an $8mn loan from Asakabank JSCB, reflecting ongoing corporate financing and economic growth within Uzbekistan.