The Central Bank of Uzbekistan has expressed growing concern over the increasing debt burden on the country’s population, highlighting potential financial risks linked to loan repayments. The warning came in the bank’s 2024 Financial Stability Review, which stresses challenges facing borrowers and banks alike.

Debt Burden Growing Among Borrowers

In 2024, the average debt burden — defined as the share of credit repayments relative to monthly income — stood at 34% nationwide. However, a significant portion of borrowers are spending as much as half of their monthly income on repaying loans. This group accounts for 40% of total loans, a figure the Central Bank describes as “very large.”

The report warns that if the economy experiences a downturn due to rising prices, falling wages, or increasing unemployment, banks could face significant losses. By 2027, four major banks risk falling below the minimum required capital adequacy ratio, threatening their financial stability.

Current Liquidity Situation Stable but Risks Remain

Despite these concerns, liquidity risks in banks are currently low. Most commercial banks are expected to maintain sufficient cash and liquid assets through 2025, with reserves able to cover potential negative cash flow.

However, many banks remain highly dependent on deposits from a few large customers. Should these clients withdraw funds simultaneously, banks could encounter financial difficulties.

Housing and Auto Loan Markets Show Divergent Trends

The housing market has seen a 17% increase in prices in 2024, contributing to financial risks. Mortgage lending conditions have tightened, and although mortgage loan balances have slightly decreased, they remain high.

Conversely, the auto loan market has improved. Banks are more cautious in granting car loans, easing the population’s debt burden in this sector. Car prices have also stabilized.

Microloans Pose Significant Credit Risks

The report highlights microloans as a major area of concern. Some banks hold high shares of problem loans in this category and lack sufficient reserves to cover non-performing loans.

The growing number of microborrowers further increases the risk of future financial instability.

Global Economic Instability Adds Pressure

The Central Bank’s review also points to ongoing global economic uncertainty in 2024, driven by geopolitical conflicts, wars, sanctions, and trade disputes. These factors have negatively impacted international trade and investment, heightening economic risks worldwide.

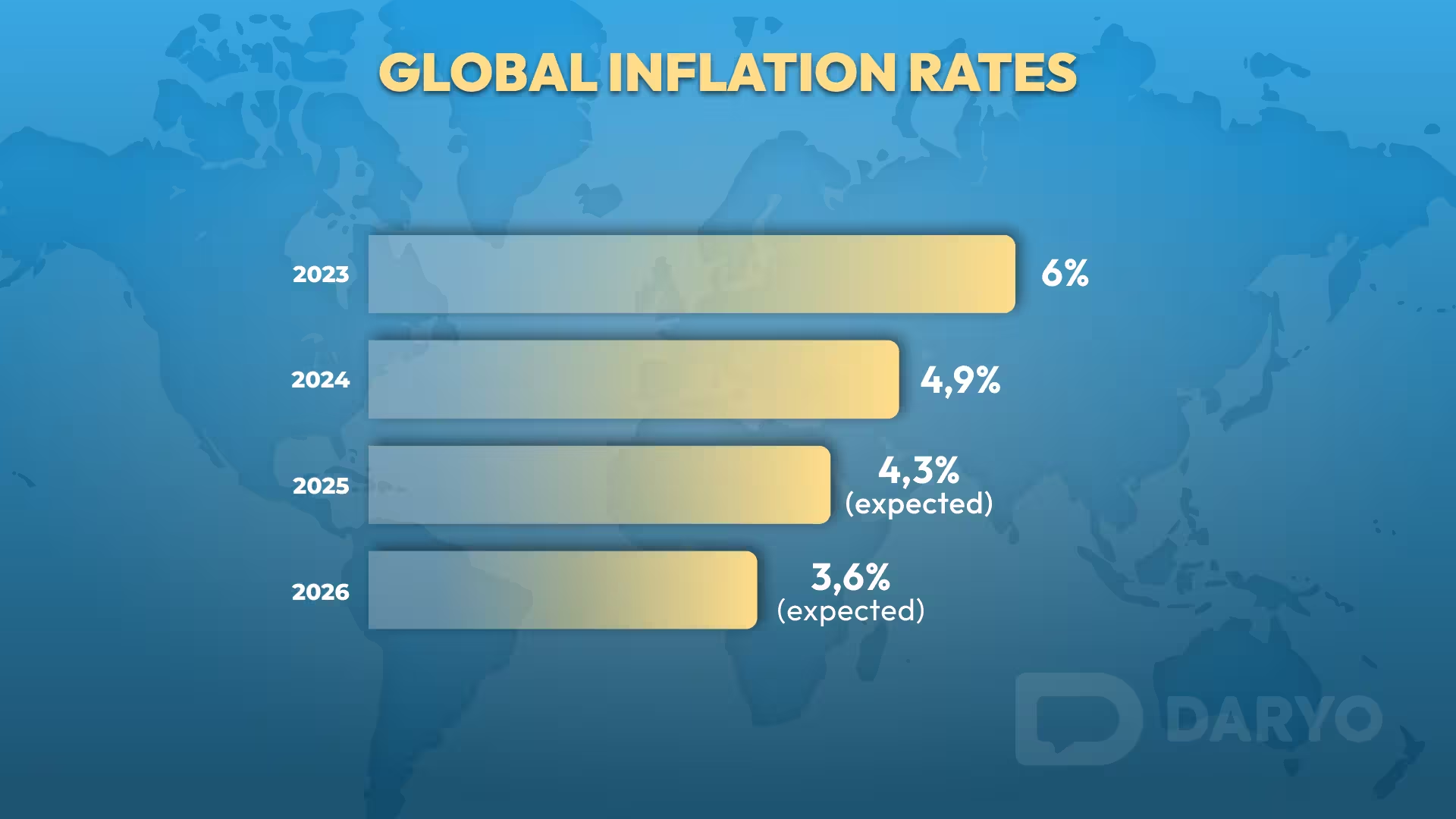

Although global inflation eased to 4.9% by the end of 2024, the International Monetary Fund forecasts a continued decline in 2025 and 2026. Still, geopolitical tensions and economic fragmentation could trigger renewed inflationary pressures, forcing central banks to maintain high interest rates — potentially making borrowing costlier and more difficult.

Exchange Rate and Other Risks

The Uzbek soum depreciated by 4.7% against the U.S. dollar in 2024, a slowdown compared to 10% in 2023. Still, exchange rate fluctuations remain a key concern.

A Central Bank survey conducted in 2024 identified the following top risks to Uzbekistan’s financial system:

- External geopolitical risks (war, political instability): 53%

- Accelerating inflation: 37%

- Sharp exchange rate fluctuations: 35%

- Rising debt burden of the population: 29%

- Risk of loan non-repayment: 27%

- Cyberattacks: 24%

Other risks cited include liquidity problems in banks, defaults by large borrowers, economic downturns, and climate change impacts.

Outlook on Systemic Risks and Confidence

While 56% of survey respondents assessed the likelihood of systemic financial risks within the next year as low, 61% expect a medium risk level over the next 1–3 years. Confidence in Uzbekistan’s financial system remains relatively strong: 67% expressed increased confidence over the next three years, while 31% reported moderate confidence.

Overall, the Central Bank’s review suggests that although a serious economic crisis is not expected imminently, medium-term risks related to debt burdens and external factors warrant careful monitoring.