The Tashkent Stock Exchange experienced a notable decline in trading volume from August 5 – August 16, with the total volume amounting to approximately $475,891 (UZS 6bn). This represents a nearly tenfold decrease compared to the previous period, a drop largely attributed to the absence of mergers and acquisitions (M&A) transactions that had previously driven significant market activity as reported by the Avesta Investment Group.

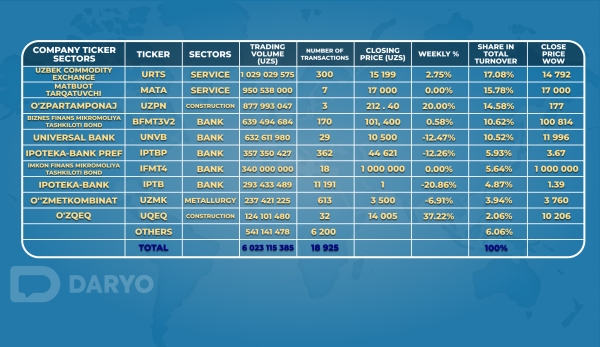

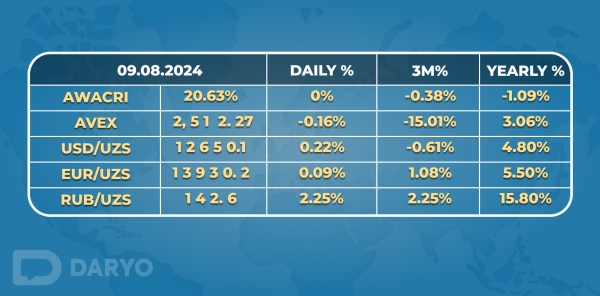

In addition to the drop in volume, the total number of transactions conducted on the TSE reached 18,925, reflecting a 16.2% decrease from the previous period. Despite the reduction in the number of transactions, the total number of entities traded over the last two weeks saw a slight increase, rising to 68 up by one from the previous period. The most active sectors on the stock exchange during this time were services, banking, construction and metallurgy indicating ongoing investor interest and activity in these areas. Several notable price changes were observed among specific securities. UZPN and UQEQ both experienced significant price increases rising by 20% and 37.2% respectively. On the other hand, UNVB, IPTBP and IPTB saw their prices decline by 12.5%, 12.3% and 20.9% respectively. Additionally, AVEX registered a decrease of 2.2% over the two-week period, while AWACRI saw a slight dip in its price from 20.7% to 20.6% following a 50 basis point reduction in the key refinancing rate by the Central Bank of Uzbekistan.

In the broader economic landscape, Uzbekistan plans to launch a $10mn venture fund aimed at supporting the development of a startup environment. In another initiative, President Shavkat Mirziyoyev signed a decree to develop financial factoring services for accounts receivable in Uzbekistan with these services expected to be available in both local and foreign currencies. Uzmetkombinat JSC (UZMK), a key player in Uzbekistan’s industrial sector successfully extended a $100mn loan from Citibank under a previous 1+1 agreement further solidifying the company’s standing with international creditors. This extension is particularly crucial as it supports the progress of UZMK’s new casting and rolling complex. In another development, Abu Dhabi Sustainable Water Solutions signed a contract with SUEZ and Marubeni to construct a new water treatment facility near Tashkent, reflecting ongoing efforts to improve infrastructure in the region. However, challenges remain in the financial sector as evidenced by the significant drop in the volume of car loans issued in the first half of 2024 which amounted to $7bn (UZS 8.9 trillion) —half the volume seen in the first half of 2023. On the defense front, Sierra Nevada Corporation was awarded a $64.2mn contract to repair six PC-12 planes for Uzbekistan’s air forces demonstrating ongoing international cooperation in defense. Additionally, Uzbekistan announced plans to increase minimum salaries and the basic unit size by 10% starting october 1st along with a 10-15% increase in salaries for budget workers from september 1st and october 1st.

The automotive sector also faced a downturn with monthly car sales in July decreasing by almost 30% year-over-year. In contrast, Uzbekistan Railways JSC successfully completed the modernization of the Hayraton-Mazar-i-Sharif railroad, enhancing the connection between Central Asia and Afghanistan. Foreign reserves in Uzbekistan saw an increase from $36.3bn to $37.4bn, including $1.8bn in gold, which translates to 0.4mn ounces in physical terms. The tourism sector also showed promise with foreign tourist arrivals projected to reach 10mn by 2024. In the first half of 2024, 3.5mn tourists visited Uzbekistan, a 13.3% increase compared to the same period in 2023. Several key developments in the financial and corporate sectors were also reported. Ipak Yuly Bank JSCB (IPKY) signed two bank loan repayment insurance contracts, each worth $42mn (UZS 530bn) with Alfa Invest JSC and Uzbekinvest JSC (UZIN). Uzbekneftegaz JSC (UZNG) made a significant capital infusion of nearly $79mn (UZS 1 trillion) into its charter capital. In a move to streamline operations, EOPC JSC (UzCard), ATTO JSC and Plum Technologies JSC reorganized their management structures introducing UCMG LLC as a management company to oversee their operational processes. Lastly, the Uzbekistan Mortgage Refinancing Company JSC listed its corporate bonds on the Tashkent Stock Exchange, further expanding its financial activities.