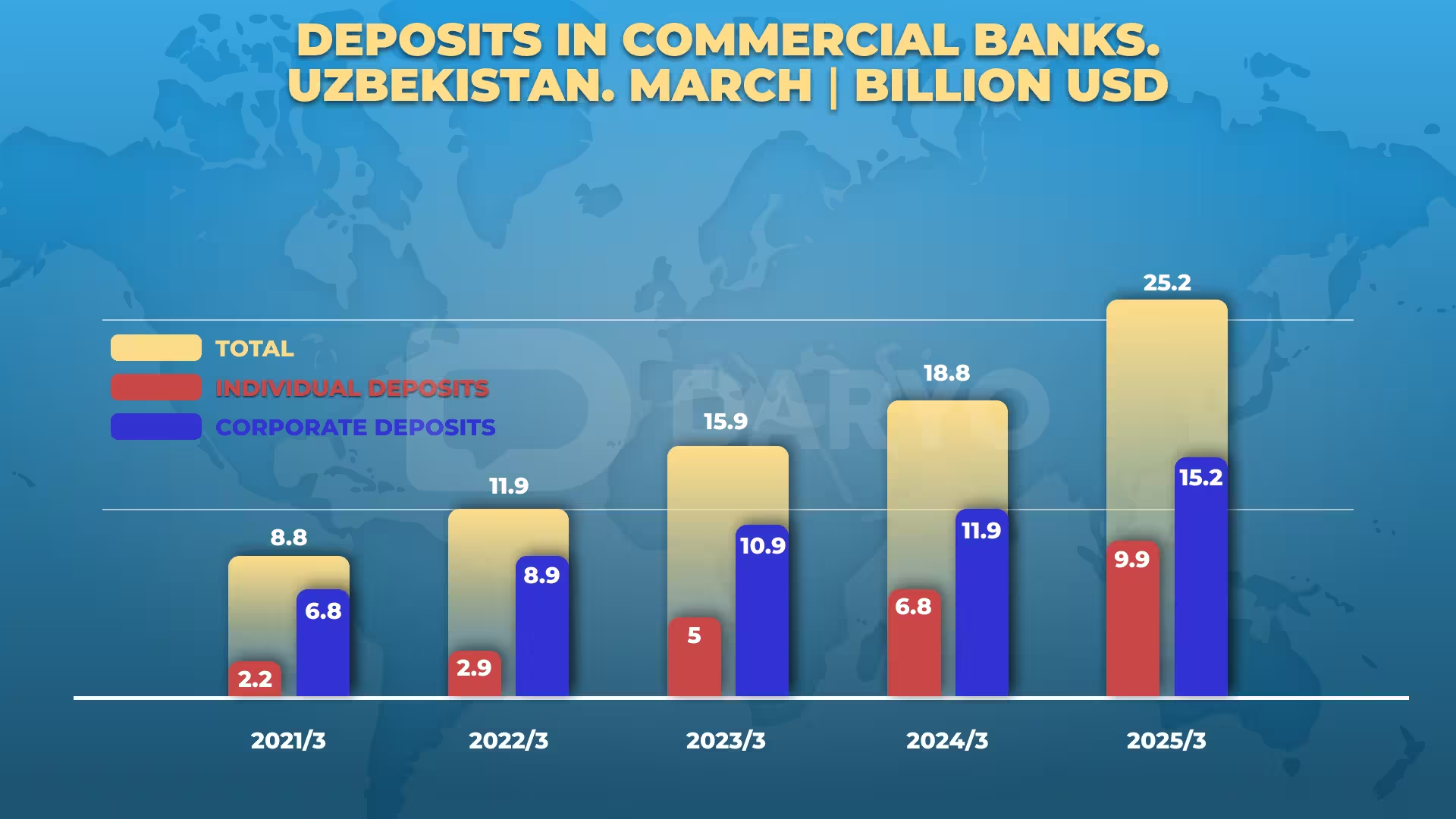

The banking sector in Uzbekistan has witnessed significant growth, with deposits in commercial banks surging by over a third in just one year, reaching a total of UZS 326 trillion ($25.2bn) by March 2025.

A notable shift has occurred in the structure of deposits, with retail deposits growing by 45.9% to UZS 129.2 trillion ($9.9bn), accounting for 39.6% of the total. Corporate deposits also saw a healthy rise of 27.3%, amounting to UZS 196.8 trillion ($15.2bn).

The capital, Tashkent, continues to dominate the banking landscape, holding a commanding 77.1% of all deposits in the country, equating to UZS 251.3 trillion ($19.4). Tashkent’s retail deposits account for 59.3% of the capital’s total, while its corporate deposits make up a striking 88.8% of the city’s deposits. In stark contrast to other regions, Tashkent is the only area where corporate deposits outpace retail deposits, with the former standing at UZS 76.6 trillion ($5.9bn), or 30.5% of the total.

Other regions lag far behind in terms of deposit volumes, with Samarkand, Bukhara, and Khorezm regions collectively holding UZS 25.1 trillion ($1.9bn). In these areas, retail deposits have a stronger presence, with the share of retail deposits in regional portfolios ranging from 51.9% in Andijan to 86.2% in Khorezm.

Banks with state participation continue to play a pivotal role in Uzbekistan’s banking sector, holding more than half of the total deposits. Their combined share grew slightly from 50.2% in March 2024 to 51.3% in March 2025. However, these state-affiliated banks represent only 9 out of the 36 commercial banks operating in the country.

Among all the banks, the Uzbek National Bank leads with the highest deposit volume of UZS 38 trillion ($2.9bn). It is followed closely by Kapitalbank, with UZS 36.2 trillion ($2.8bn), and Xalq banki, with UZS 26.1 trillion ($2bn).

In terms of deposit duration, long-term deposits—those exceeding one year—make up the majority, totaling UZS 124.6 trillion ($9.6bn), a 40.1% increase from the previous year. Shorter-term deposits have also seen notable growth, with deposits for six months to a year rising by over 50% to UZS 58.4bn ($4.5mn). Demand deposits, on the other hand, now account for nearly 40% of the total, amounting to UZS 92.6 trillion ($7.2bn), marking a 34.1% increase from March 2024.